Where are the regional peaks of oil and gas ?

The international energy agency, in its recent report, thinks that we should need to triple the unconventional oil production from the US in order to avoid a decrease of the total crude oil production by 2025. The agency also adds that it only predicts at best a doubling of this nconventional oil production by then. Hence, between the words, one infers that it annouces an peak oil before 2025. We now know from the same agency that the conventional peak oil was passed somewhere around 2006, and indeed we saw the economic consequences immediately after… Hence, monitoring the evolution of oil and gas extractions, amounts to anticipating on the evolution of our economies.

We shall first look at the difficulties to come by examining area by area the productions and consumptions of fossil fuels. We restrict here the analysis to oil and gas because coal is still very far from its anticipated peak (but regionally the peak has been passed, like in Europe), and it does not travel very easily. In order to avoid a massive global warming one needs anyway to leave most of it in the ground.

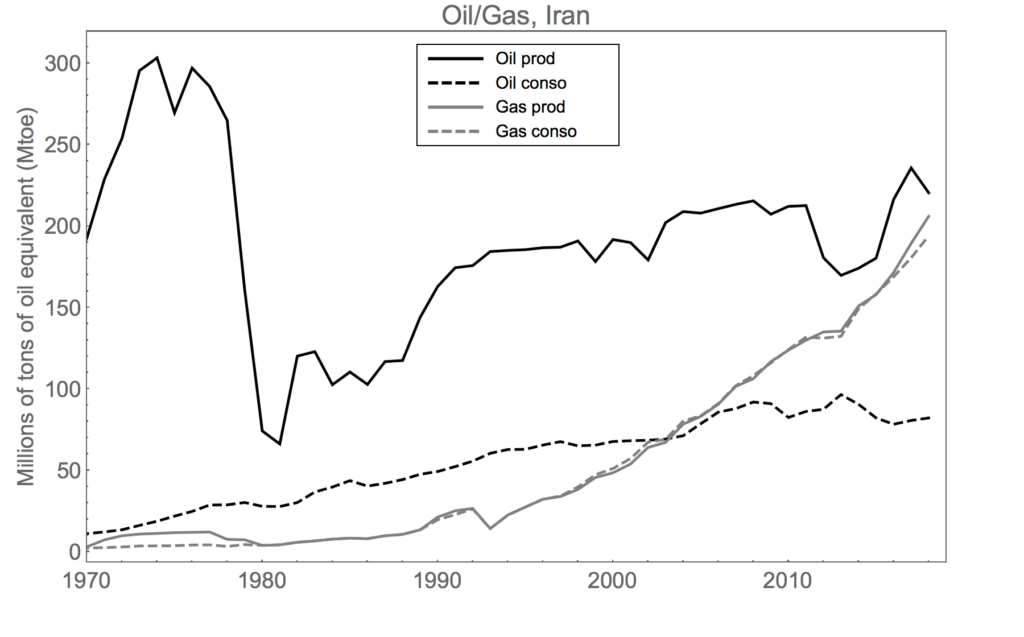

Some areas are going to hit difficulties before the world peak oil (and peak gas), whereas other regions are safe for a few decades at least (in Middle-East most notably). This helps understanding and predicting the economic difficulties to come in the near future, since our societies still rely heavily on fossil fuels, despite of our attempts to shift the energy sources to renewables.

NB : This article is a stub. Not all countries are studied in the following. More information can be found on crudepeakinfo.

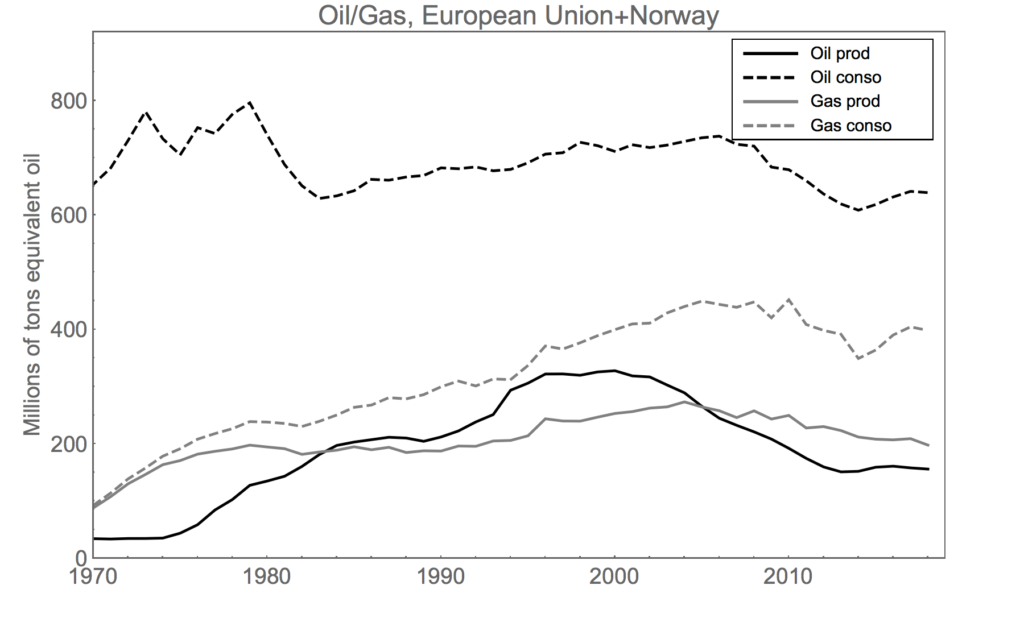

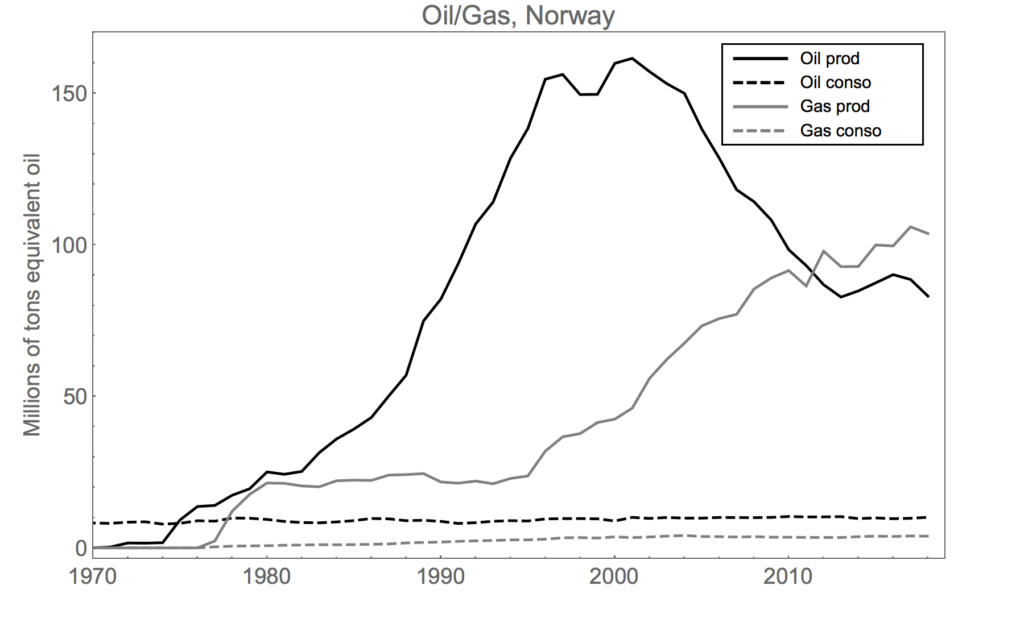

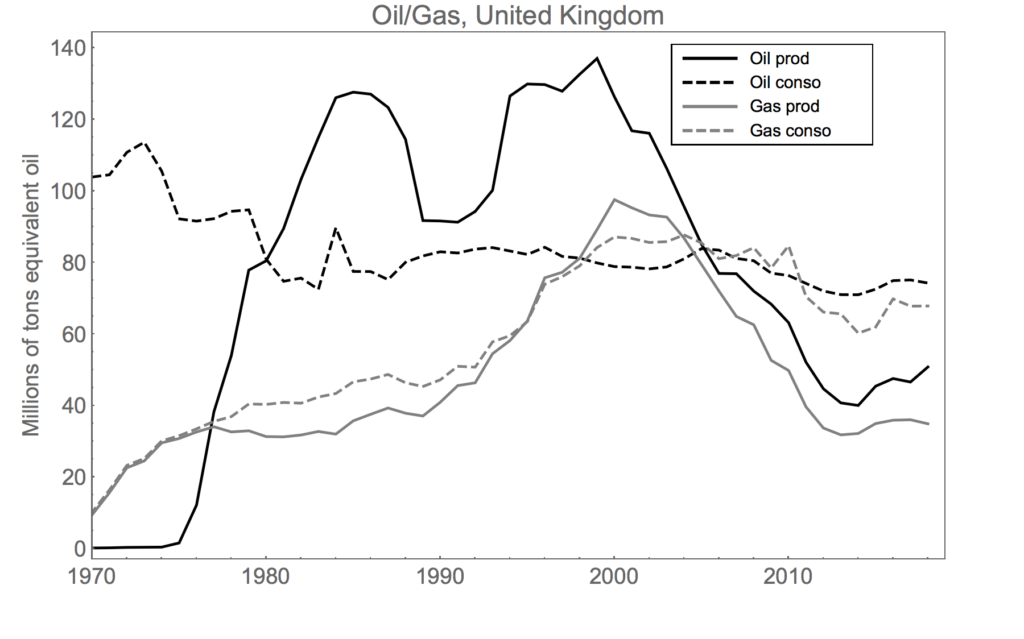

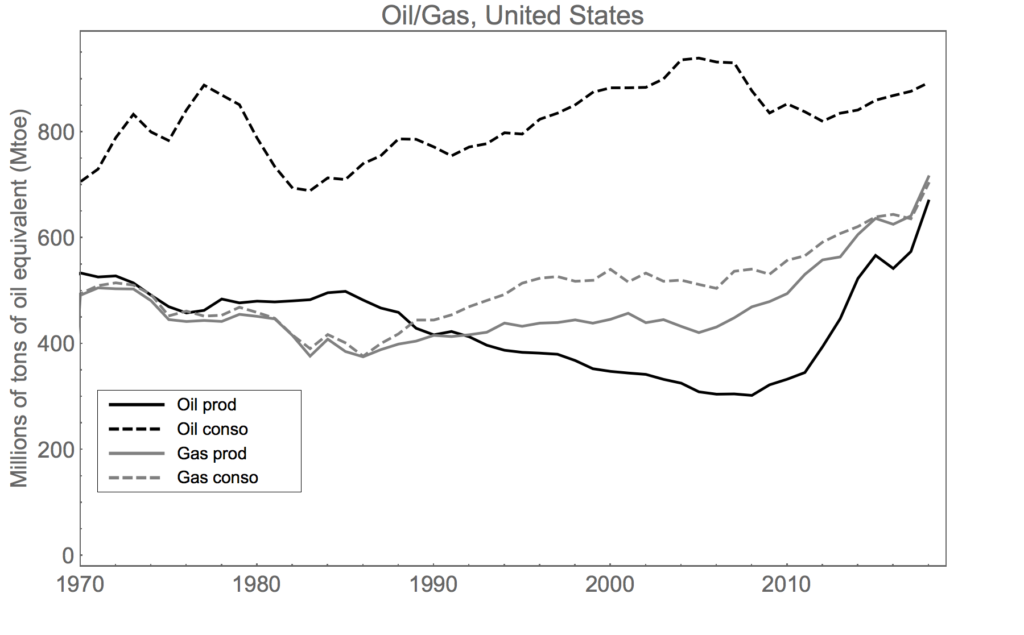

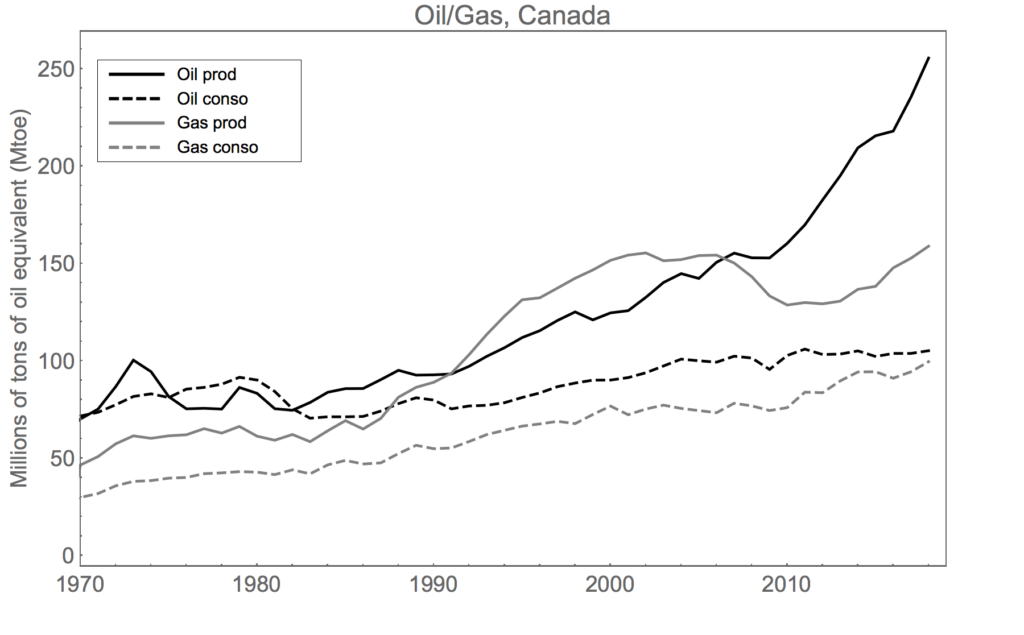

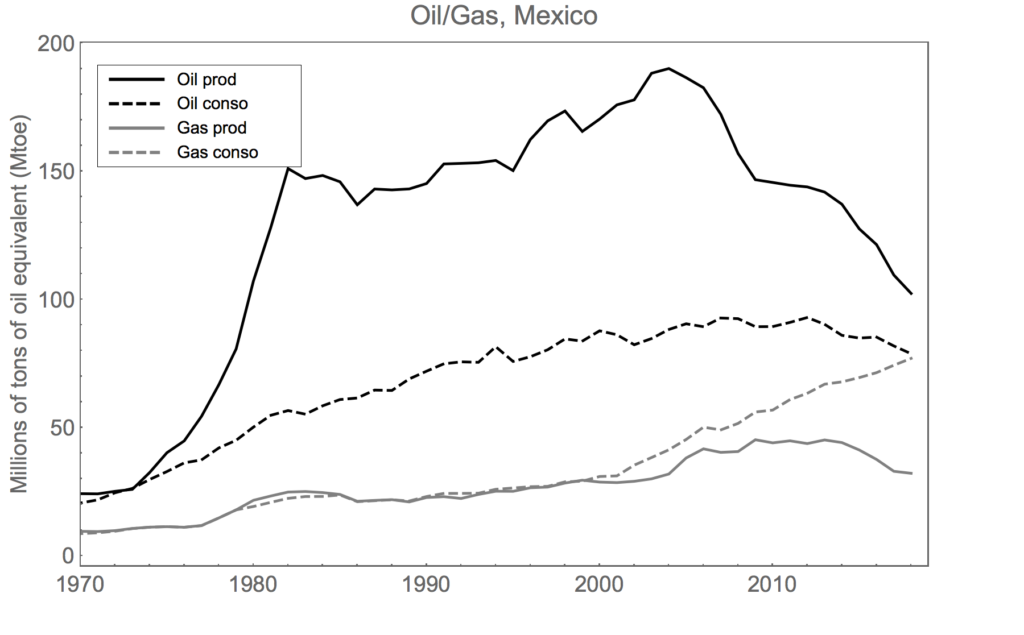

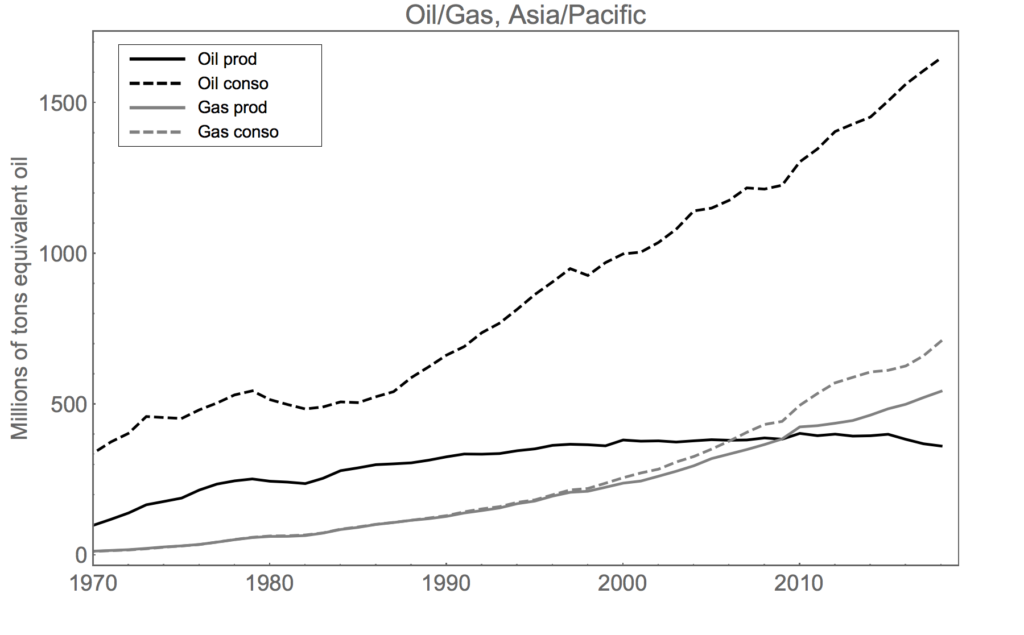

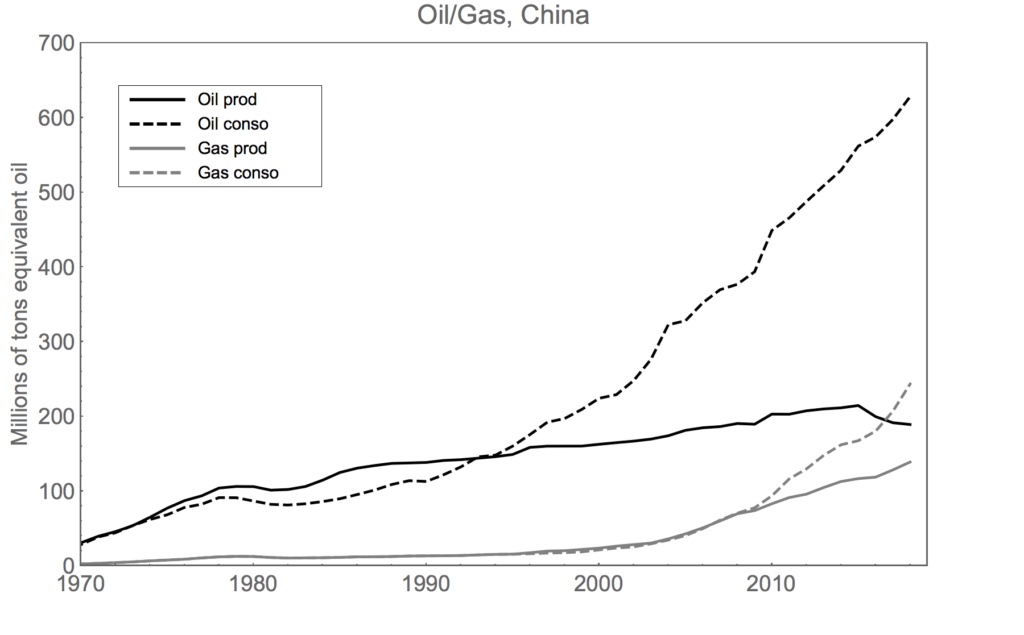

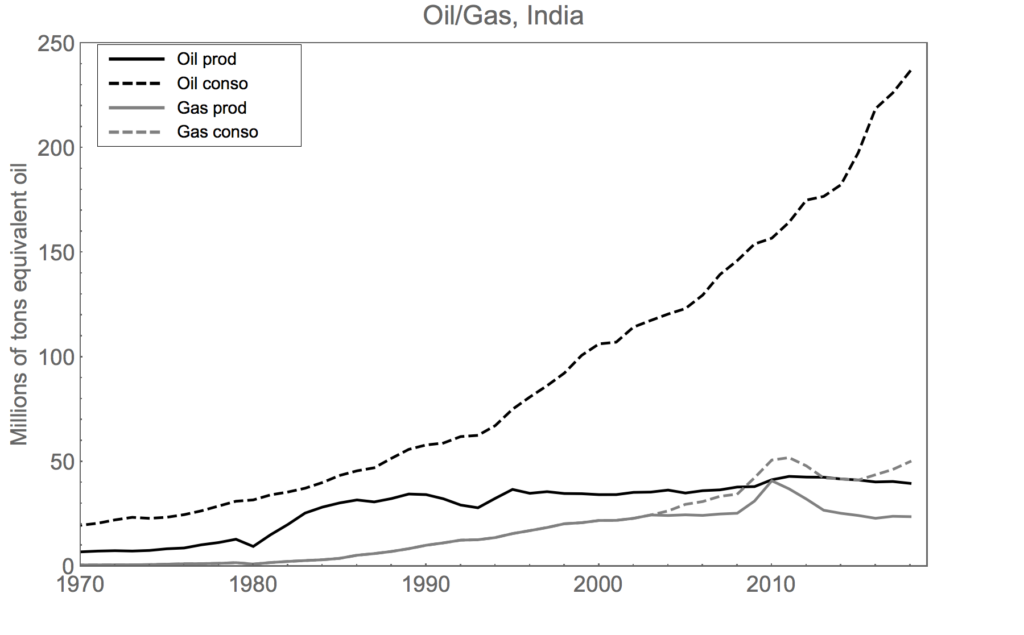

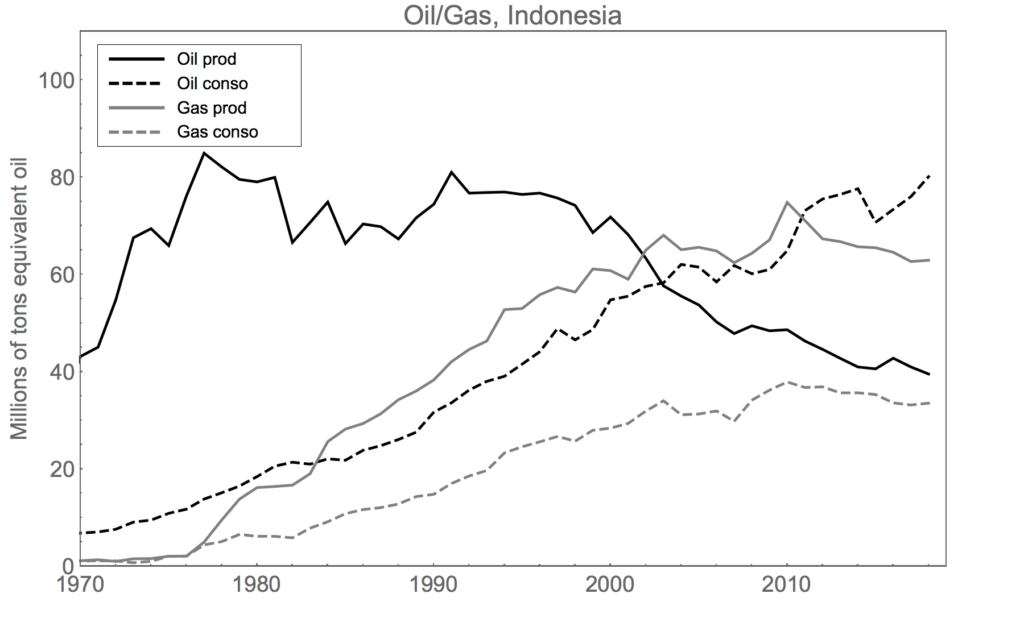

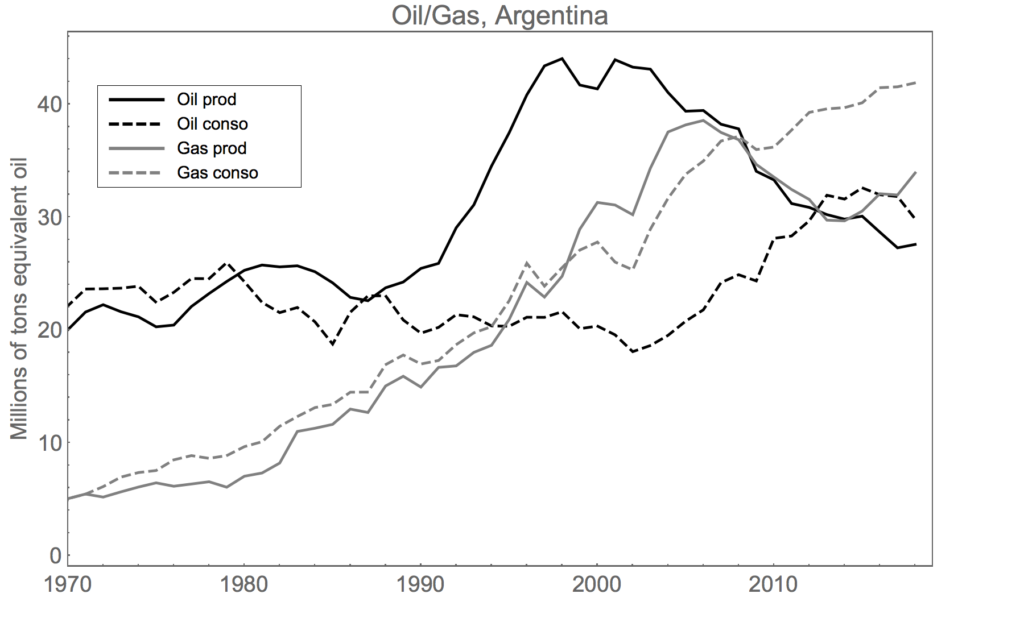

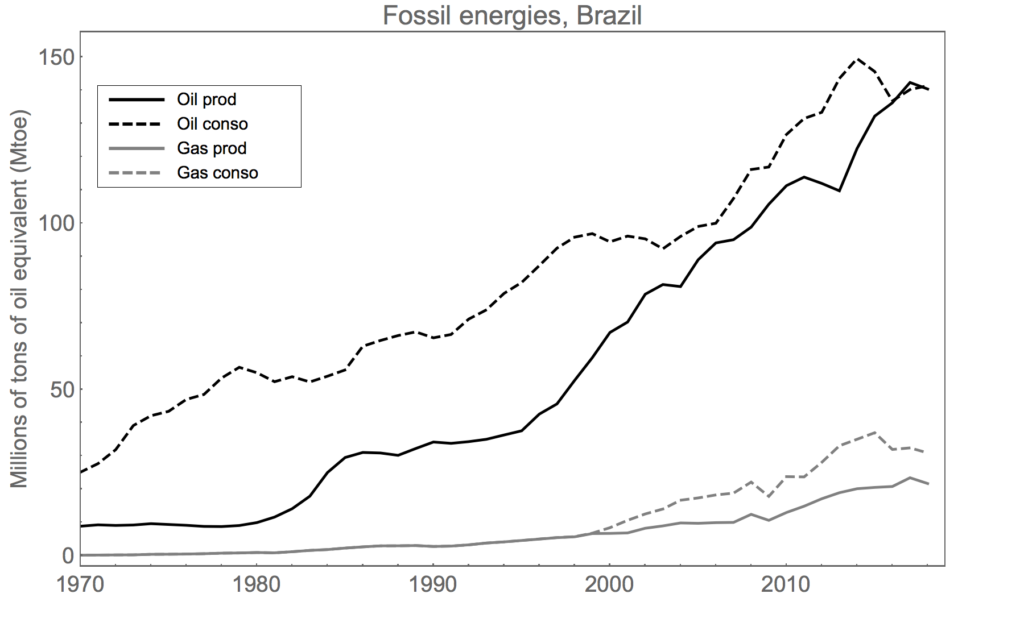

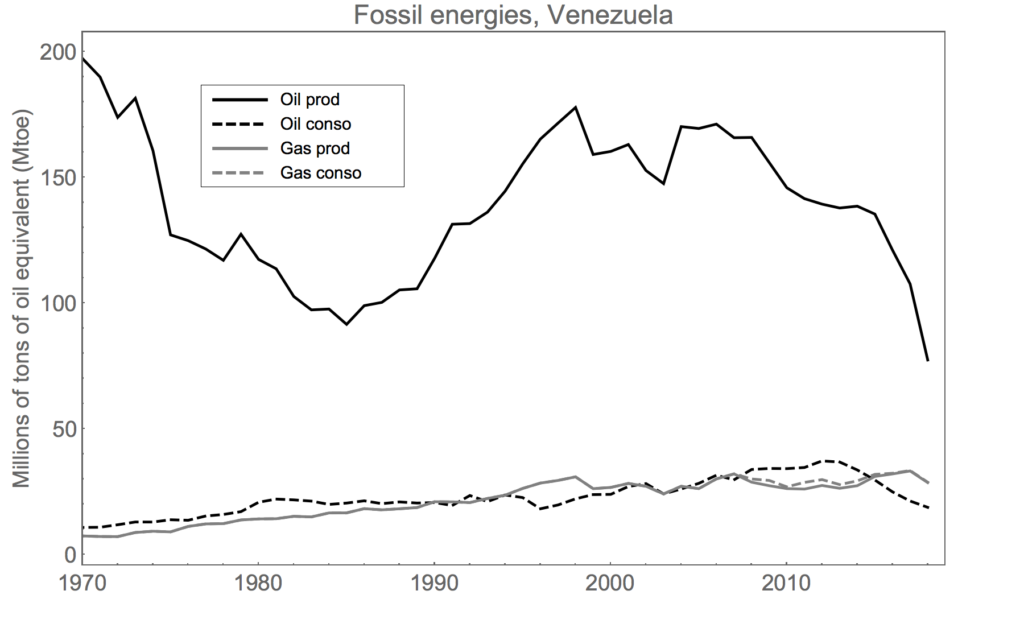

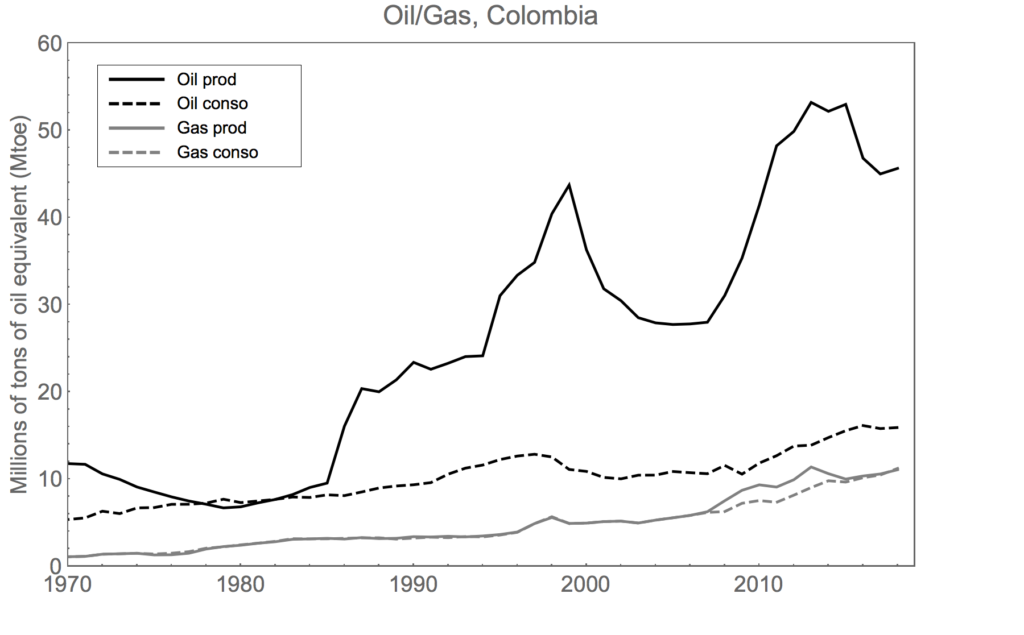

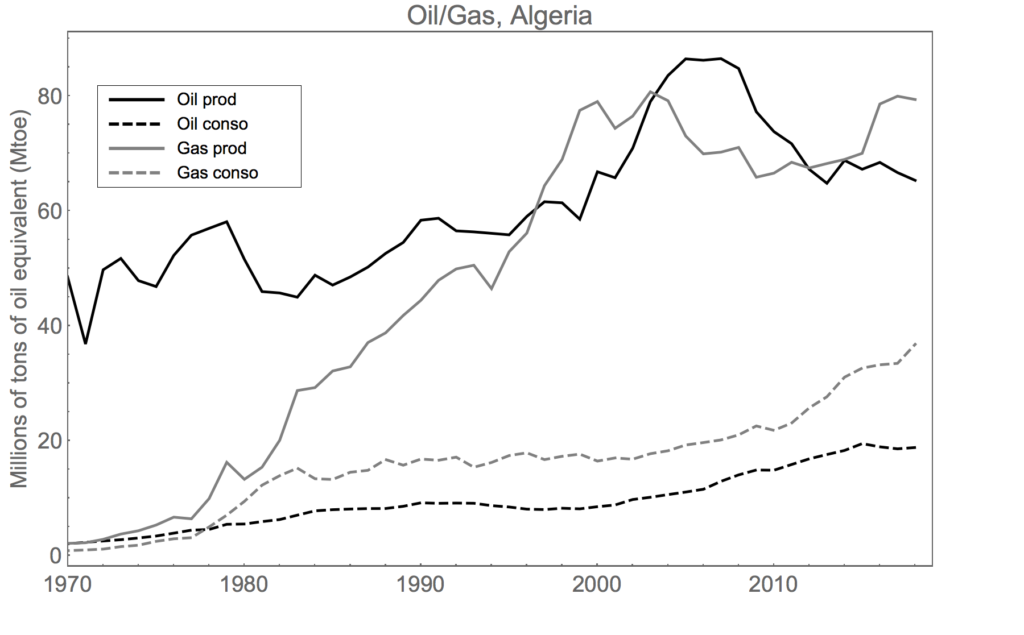

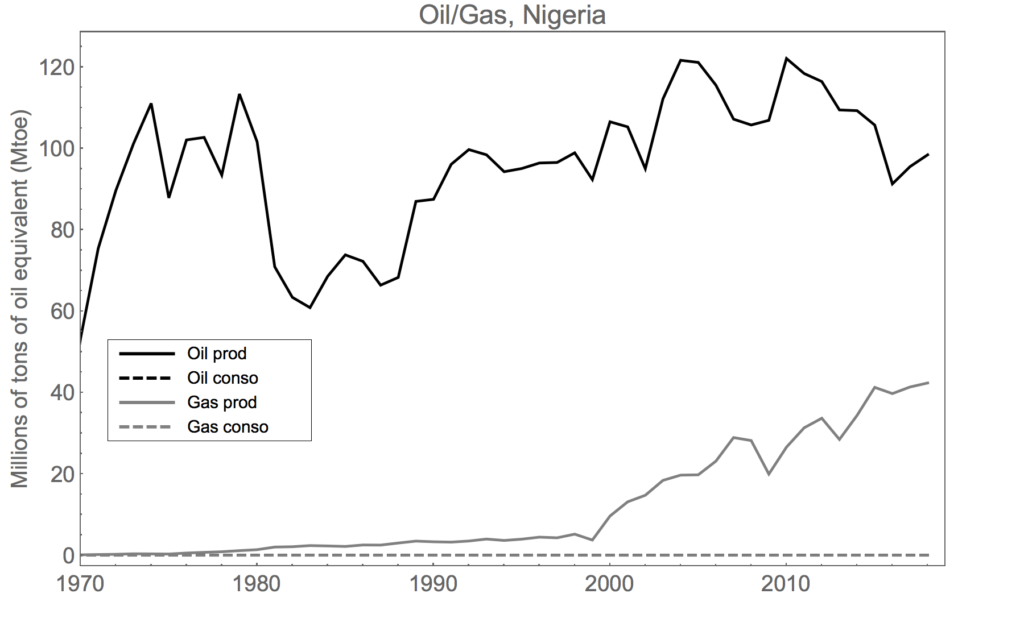

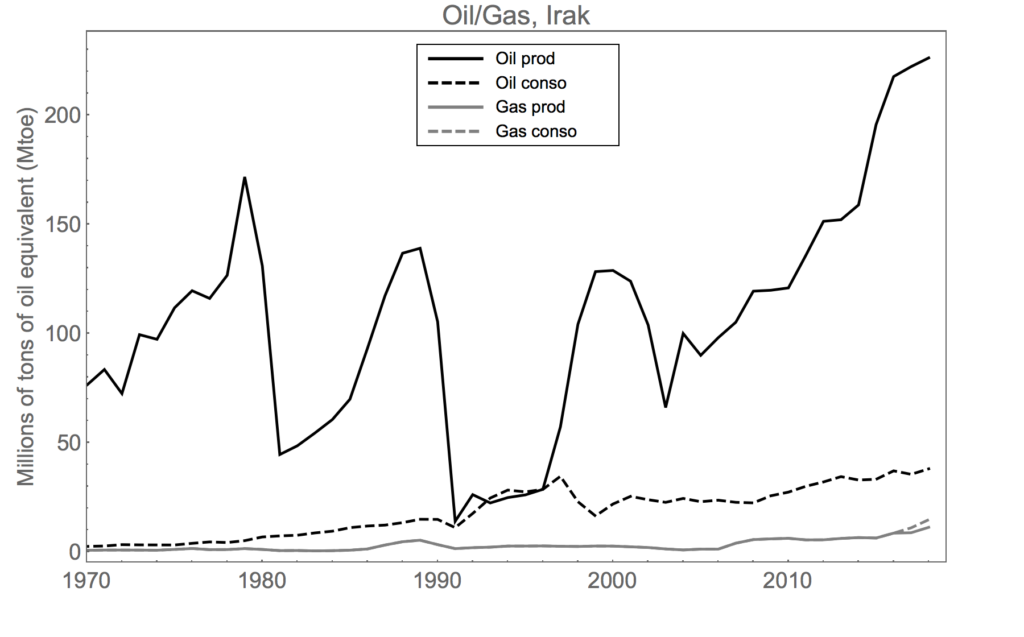

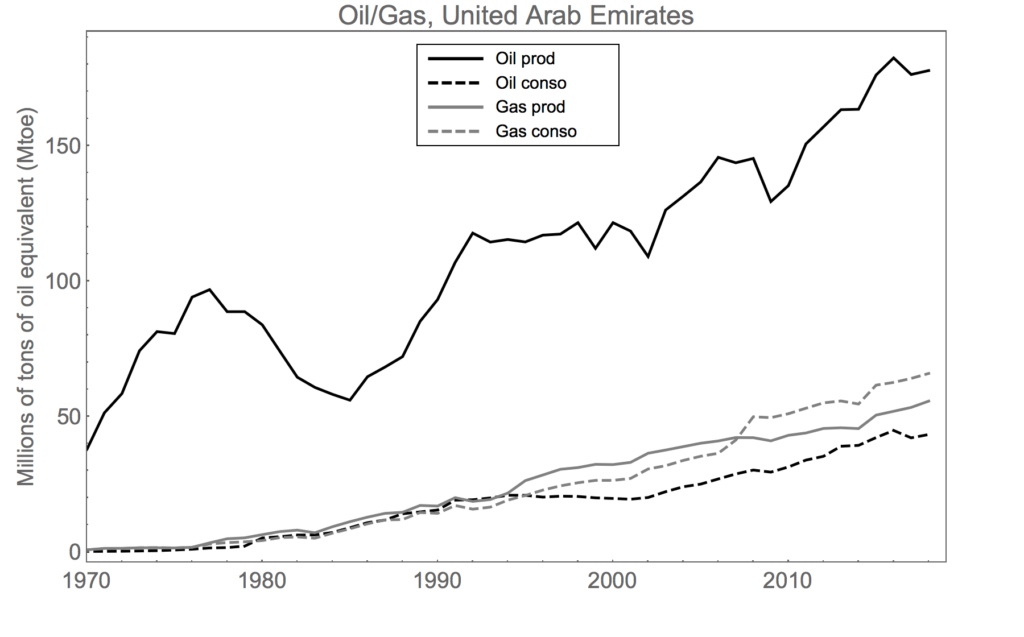

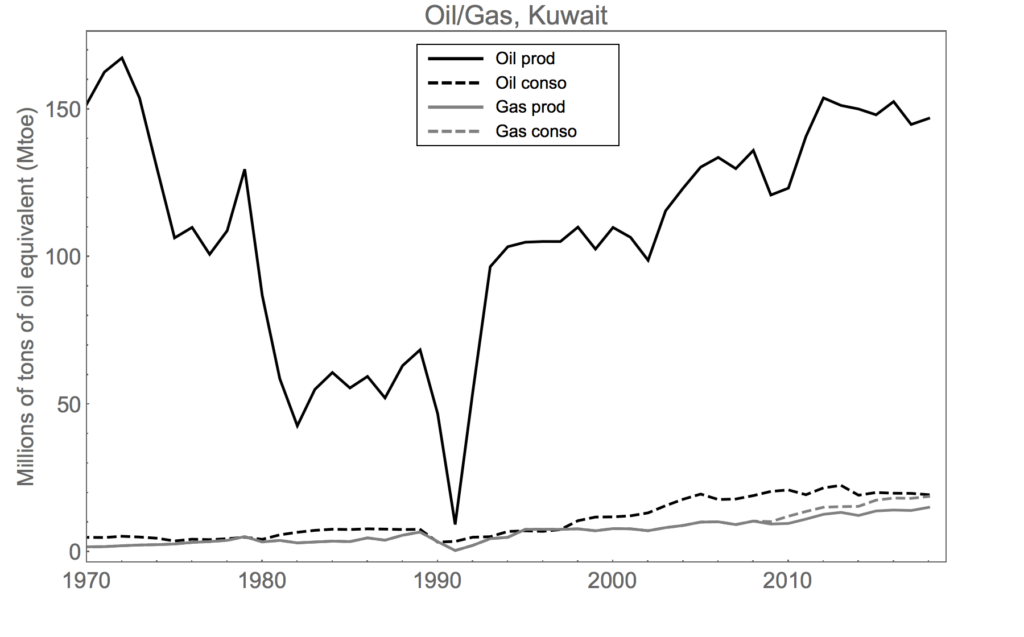

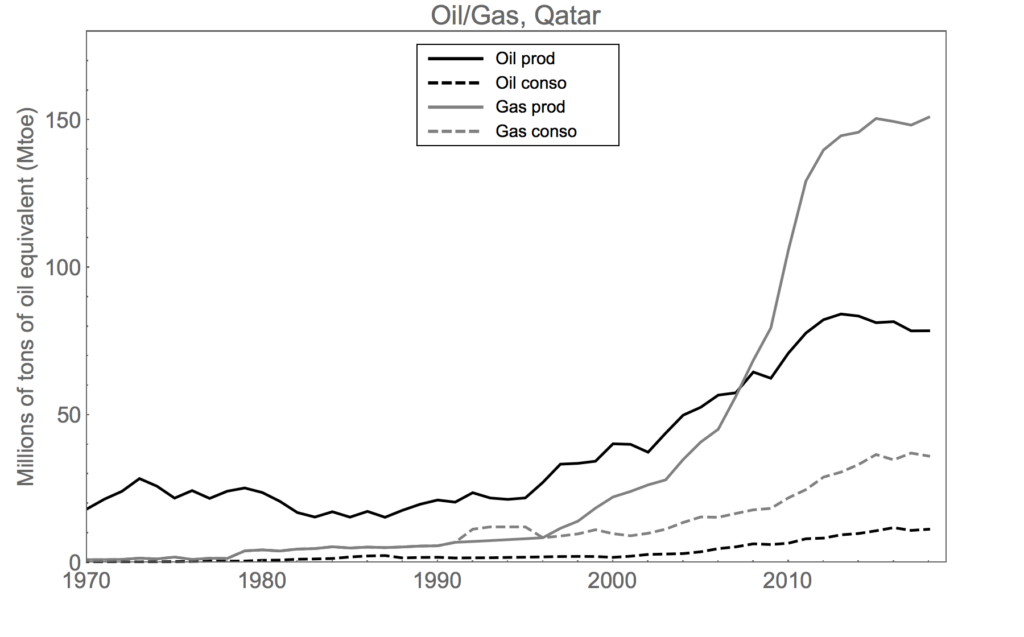

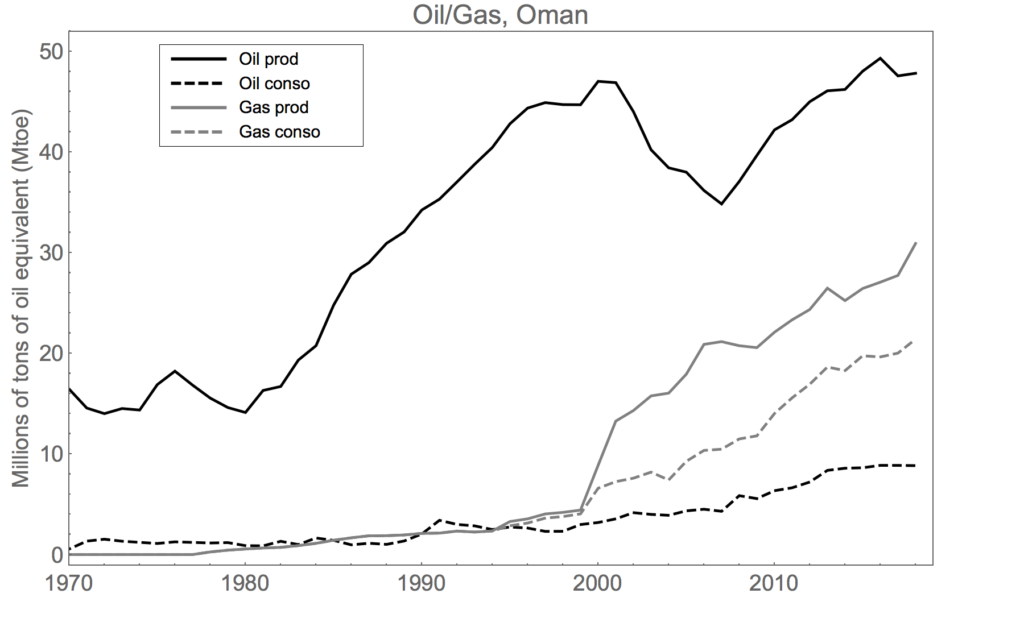

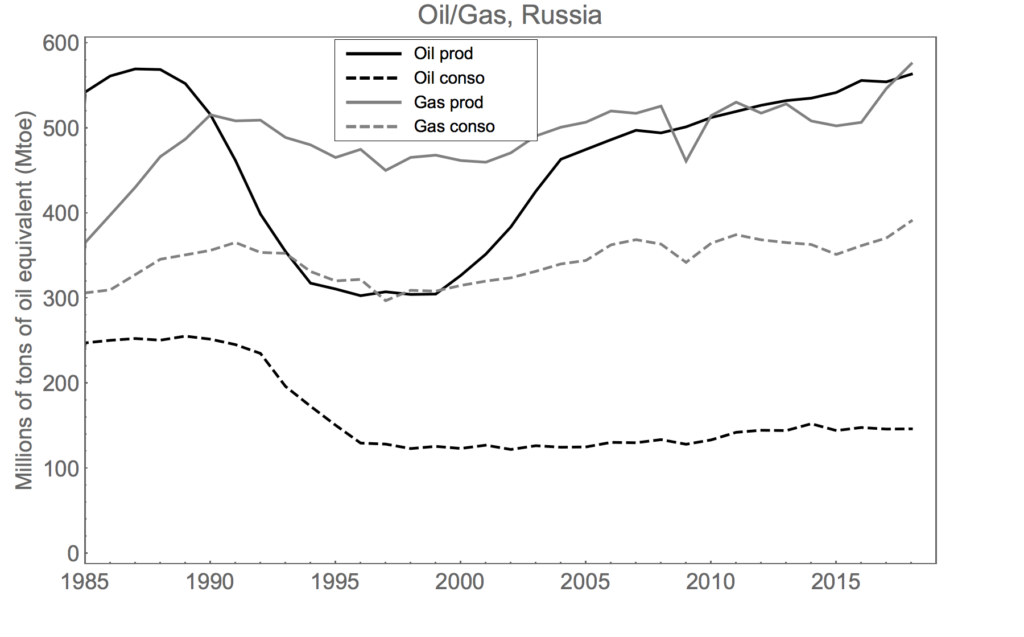

Energy quantities are reported in millions of tons of oil equivalent (Mtoe). Thick lines are for production and dashed lines correspond to consumption.

Europe

The European Union (with UK and Norway of course added) passed its peak oil around 2000, and its peak gas around 2004. The new large field in Norway won’t change this trend.

North America

The peak oil was arond 2004 in Mexico 2004. However, the production is still larger than the domestic consumption. The difference between both has decreased a lot after 2012 and if the trend is confirmed, we anticipate that Mexico will need to import oil. Since this country is also a net importer of gas, we anticipate an economic crisis in a near future, with new hunger riots.

Asia/Pacific

The Asia/Pacific region has passed its peak oil somewhere between 2000 and 2010.

China recently passed its peak in 2015.

Indonesia has passed its peak oil around 1990 and its peak gas around 2010. It is now a major importer of oil. For the moment it is still growing economically, and this is due to a booming coal industry able to supply the energy consumption needs. The output of coal is so huge that it amounts to nearly twice the total primary energy consumed in Indonesia. Hence, even though it is a net importer of oil, its economy does not suffer from it,

South America

Argentina is sadly the perfect case of a local peak oil. The parity between the peso and the US dollar was maintained until its peak oil in 2000. Once passed, the exports of oil have decreased and the commercial deficit became intolerable for the currency parity. Devaluation, recession…. But the country could recover because the extraction of oil remained larger than its domestic consumption. The second crisis happened when the consumption has overshot the domestic production for both gas (around 2007) and oil (around 2012). After that, the only possible adaptation was to reduce the energy consumption, and this triggered a recession. As is also the case for Italy, the contraction of the energy supply leads at best to a stagnation if many efforts are put into energy efficiency, and to a recession otherwise.

From 2010 onwards, the difference between production and consumption (which is larger) started to increase. Brasil is in recession since 2014, allowing to reduce this difference. For the moment, Brasil has huge off-shore reserves (15 billions of barrels, that is half the world consumption in one year) but as soon as the production decreases in the future, its economy should follow Argentina’s fate.

In the case of Venezuela, it is difficult to tell if oil extraction has decreased because of economic collapse, or if it is the contrary. The reserves in Venezuela are huge, of the order of 300 billions of barrels (more than Saudi Arabia !), hence everything is possible for its economic development.

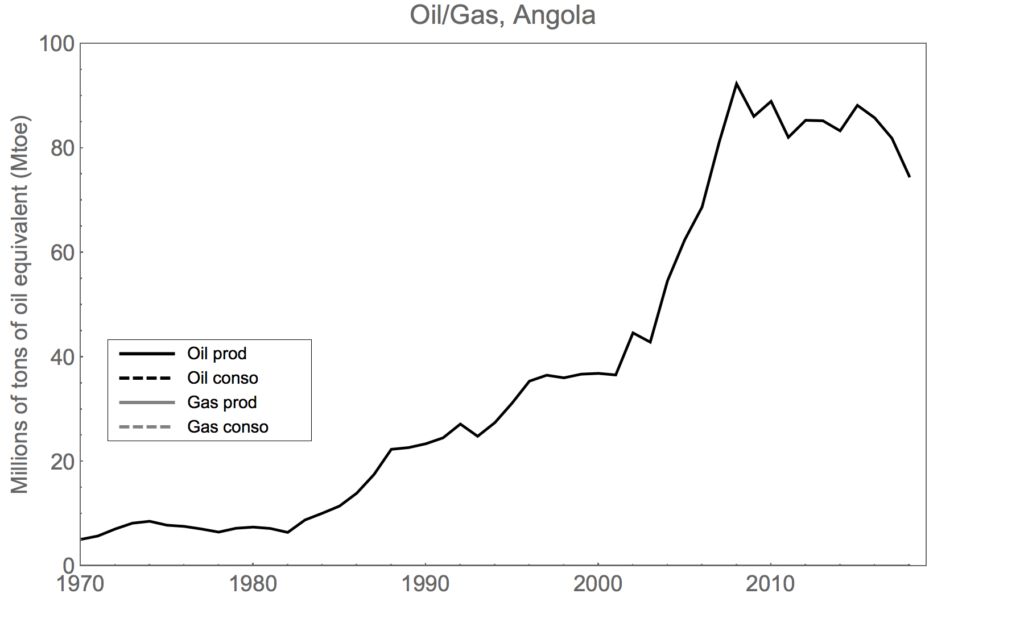

Africa

Algeria went through the peak oil in 2006. It seems there was a peak gas in 2016 but we must wait to tell for sure. For the moment its production is much larger than its domestic consumptionm hence its situation is not that bad. We can anticipate than within 15 years, its production should go below its consumption.

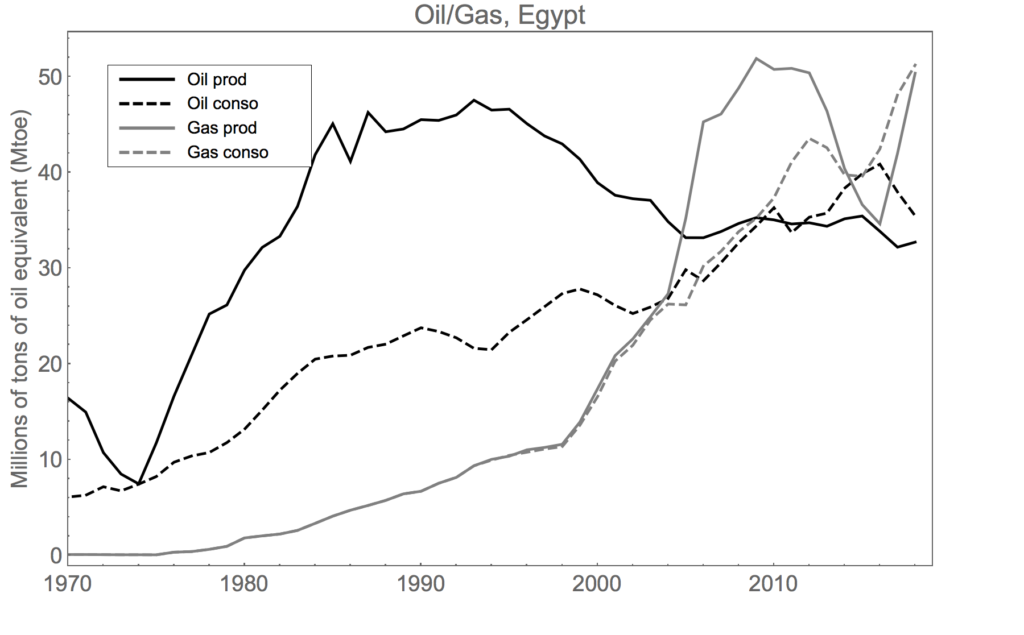

In Egypt, the peak oil was passed in 1992 and the country became a net importer in 2011, affecting the economy and thus the stability of the country.

Middle-East

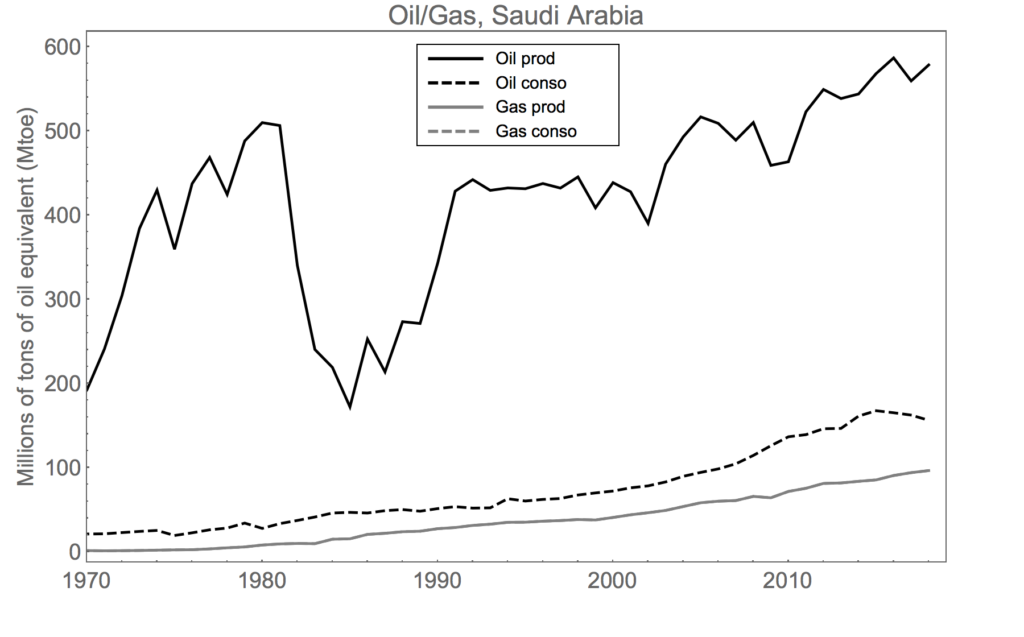

Saudi Arabia is still very far from its peak.

Russia

The Russian government announced its peak oil for 2021. Only the future can tell.

If you liked this post, do not hesitate to share it with the buttons below. If you would like to receive notifications for new posts, you can sign up with your mail address on the top of the right column.

Thanks !

Image by Johannes Plenio from Pixabay.